In the complex world of finance and real estate, there’s a common misconception that Federal Reserve rate cuts directly lead to lower mortgage rates. This belief, while understandable, oversimplifies the intricate relationship between various economic factors and the mortgage market. In this article, we’ll delve into the truth behind mortgage rates, their connection to the 10-year Treasury yield, and why Fed rate cuts don’t always translate to an equivalent decrease in mortgage rates.

The Federal Reserve and Interest Rates

The Federal Reserve, often referred to as “the Fed,” plays a crucial role in the U.S. economy by setting monetary policy. One of its primary tools is the federal funds rate, which is the interest rate at which banks lend money to each other overnight. When you hear about the Fed “cutting rates,” it’s this federal funds rate they’re adjusting.

Many people assume that when the Fed lowers this rate, all other interest rates in the economy, including mortgage rates, will follow suit. However, the reality is far more nuanced.

Mortgage Rates and the 10-Year Treasury Yield

Mortgage Rates and the 10-Year Treasury Yield

To understand how mortgage rates are determined, we need to look at a different financial instrument: the 10-year Treasury bond.

Dr. Lawrence Yun, Chief Economist at the National Association of Realtors, explains: “Mortgage rates are determined by the bond market, and more specifically, they closely track the yield on the 10-year Treasury note. The Federal Reserve’s decisions on short-term interest rates do not directly impact long-term mortgage rates.”

The 10-year Treasury yield is considered a benchmark for mortgage rates because the average 30-year fixed mortgage is typically paid off or refinanced within 10 years. Investors use the 10-year Treasury as a guide to determine how much return they need from mortgage-backed securities to make them a worthwhile investment.

The Relationship Between Fed Rates and Treasury Yields

While the Fed’s actions can influence Treasury yields, the relationship isn’t direct or predictable. Treasury yields are affected by a variety of factors, including:

- Economic growth expectations

- Inflation projections

- Global economic conditions

- Investor sentiment and risk appetite

Greg McBride, CFA, Chief Financial Analyst at Bankrate, notes: “The Fed can influence short-term rates, but long-term rates like those on mortgages are determined by market forces. Often, the market has already priced in expected Fed moves long before they actually happen.“

Current Nationwide Statistics

As of October 2024, the average 30-year fixed mortgage rate nationwide stands at 6.32%, according to the latest data from Freddie Mac. This is despite the Federal Reserve maintaining its target federal funds rate at 3.25% to 3.50% range.

Over the past year, we’ve seen instances where mortgage rates and the federal funds rate moved in opposite directions. For example, in March 2024, when the Fed cut rates by 0.25%, the average 30-year fixed mortgage rate actually increased by 0.10% in the following week.

Why Fed Rate Cuts Don’t Directly Impact Mortgage Rates

There are several reasons why a Fed rate cut doesn’t automatically lead to lower mortgage rates:

- Different Time Horizons: The federal funds rate is an overnight rate, while mortgages are long-term loans. They respond to different economic factors.

- Market Expectations: Often, the market has already priced in expected Fed moves. By the time the Fed actually cuts rates, mortgage rates may have already adjusted.

- Economic Outlook: If a Fed rate cut is seen as a sign of economic weakness, it could lead to concerns about future inflation, which might actually cause long-term rates to rise.

- Global Factors: International economic conditions and foreign investment in U.S. Treasuries can significantly impact yields, regardless of Fed actions.

Michael Fratantoni, Chief Economist at the Mortgage Bankers Association, states: “Mortgage rates are much more closely tied to the outlook for inflation and economic growth than to the Fed’s short-term rate. Sometimes, Fed rate cuts can even lead to higher mortgage rates if they’re interpreted as a sign that higher inflation is on the horizon.”

The Impact of Fed Policy on the Housing Market

While Fed rate cuts don’t directly lower mortgage rates, they can still influence the housing market in other ways:

- Consumer Confidence: Lower rates can boost overall consumer confidence, potentially increasing demand for homes.

- Refinancing: Even small decreases in rates can make refinancing attractive for some homeowners, stimulating activity in the mortgage market.

- Economic Stimulus: Lower rates can stimulate economic activity overall, which can indirectly support the housing market.

Dr. Mark Zandi, Chief Economist at Moody’s Analytics, explains: “Fed rate cuts are designed to support the broader economy. A stronger economy with good job growth and rising incomes is ultimately more important for a healthy housing market than the precise level of mortgage rates.”

Current Trends and Future Outlook

As we look ahead, it’s important to remember that mortgage rates are influenced by a complex set of factors. While the Fed’s policies play a role, they’re just one piece of the puzzle.

Recent data from the Mortgage Bankers Association shows that mortgage applications have increased by 5.2% over the past month, despite relatively stable Fed rates. This underscores the fact that other factors, such as housing inventory, economic growth, and inflation expectations, play crucial roles in driving mortgage market activity.

Looking forward, many economists expect mortgage rates to remain relatively stable in the near term, barring any significant economic shocks. However, they caution that predicting long-term rates is challenging due to the many variables involved.

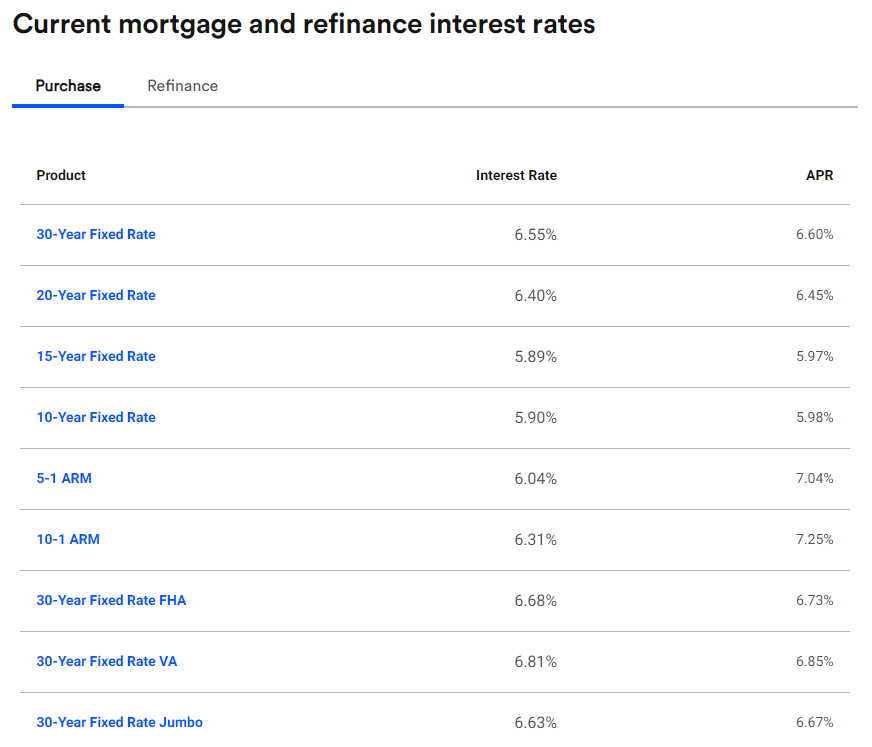

From BankRate.com:

To Sum it Up…

Understanding the relationship between Fed rate cuts and mortgage rates is crucial for anyone involved in the real estate market, from potential homebuyers to industry professionals. While it’s tempting to draw a direct line between Fed actions and mortgage rates, the reality is much more complex.

Mortgage rates are primarily influenced by the 10-year Treasury yield, which in turn responds to a wide array of economic factors. Fed rate cuts can certainly impact the overall economic environment, but their effect on mortgage rates is indirect and often unpredictable.

For consumers, this means it’s important to keep a close eye on overall economic conditions and trends in the bond market, rather than solely focusing on Fed announcements. For industry professionals, it underscores the need for a nuanced understanding of the various factors influencing mortgage rates when advising clients or making business decisions.

As we navigate the ever-changing economic landscape, one thing remains clear: the relationship between Fed policy and mortgage rates will continue to be a topic of interest and importance for years to come.